Instant and secure verification of identity documents via image or video capture from a smartphone.

Automate and secure your KYC/KYB verification processes

Discover verification solutions designed to reduce fraud, accelerate customer onboarding, and meet the most stringent regulatory and industry requirements.

Their agreements are powered by Yousign

on G2

Say goodbye to drop-offs, data entry errors, and fraud risks

Discover our modular solutions or unified KYC/KYB workflows to optimize your onboarding timelines and benefit from built-in compliance at every step.

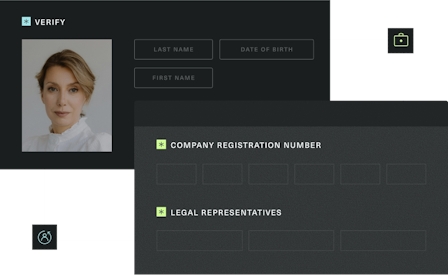

KYC – Know Your Customer

Verify your customers’ identities in seconds and proactively identify risks with verification solutions that combine security, compliance, and a seamless user experience.

Identity document verification (image, video)

Face match identity verification

Combination of video-based document verification and biometric checks to confirm that the user is the legitimate document holder.

Watchlist screening

Strengthen AML compliance by screening against more than 280 international sanctions and PEP lists (EU, OFAC, asset freezing, etc.).

Bank account verification

Instantly verify bank account data validity and ownership to secure your transactions.

Supplementary document verification

Automated verification and data extraction from various customer documents (bank statements, driver’s license, health card, etc.) to mitigate document fraud and secure onboarding.

KYB – Know Your Business

Instantly verify key company information and legal representatives to secure transactions, reduce fraud risks, and stay compliant with regulatory requirements.

Company registry verification

Automate the verification of a company’s legal existence and authenticity using official registries.

Legal representative identity verification

Retrieve information on legal representatives and verify their identities.

Watchlist screening

Strengthen AML compliance by screening against more than 280 international sanctions and PEP lists (EU, OFAC, asset freezing, etc.).

Bank account verification

Instantly verify bank account data validity and ownership to secure every transaction.

Supplementary document verification

Automated verification and data extraction from various company documents (business registry extracts, tax certificates, bank documents, etc.) to mitigate document fraud and secure onboarding.

Auditability and compliance

Verify’s reliable audit trails turn every verification into solid, traceable, and actionable evidence—supporting compliance (KYC, KYB, AML/CFT) and dispute management.

- Forged document

1 in 5 employees in Europe has already encountered a falsified digital document.

Yousign x Ipsos Barometer 2025 – “Digitalization, Security, Sovereignty”

- Identity theft

67% of European companies reported an increase in fraud in 2024, while 45% of businesses and 44% of end users were victims of identity fraud.

Business Money – Global Fraud Survey

AI-powered verification and detection of fraudulent documents

Thanks to our AI–based document verification solution, optimize your teams’ time, shorten your contracting timelines, and keep fraud risk under control.

Each document is checked for quality, readability, format, data consistency, and authenticity to detect altered or falsified documents.

- Bank statements

- Social security cards

- Proof of address

- Company documents

- Driver’s licenses...

Compatible with a wide range of document types (health documents, corporate documents, certificates, attestations, and more).

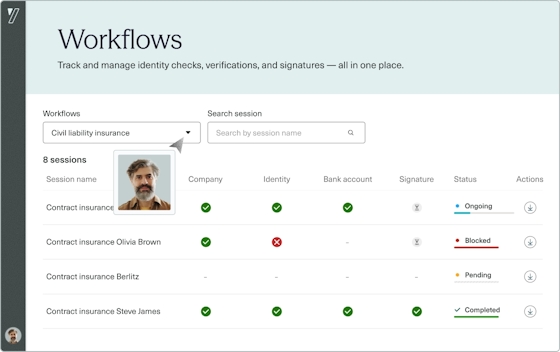

Stay in control, every step of the way.

Access a turnkey tool to monitor your clients’ progress throughout your workflow.

- Visualize the status of your sessions in real time

- Instantly detect any bottlenecks

- Easily export your audit trails anytime

Industry-specific onboarding journeys

Verify solutions

Identity verification

Validate your customers’ identities through image-based, video-based, or remote facial recognition (face matching) using biometric technology, and screen against sanctions and watchlists (PEPs) to meet KYC and AML/CFT requirements.

Company verification

Automate the verification of a company’s existence and authenticity using official registries, based on a business identifier or corporate documents.

Bank account verification

Instantly verify the validity of bank account details and account ownership using an IBAN or banking document to secure your transactions.

AI-powered document fraud detection

Whether for customer or business documents, automatically verify document integrity and leverage extracted data to feed your internal systems, databases, and contracts. With AI-powered extraction and verification, accelerate contracting processes, detect fraud attempts, and secure your operations.

Frequently asked questions

-

KYC (Know Your Customer) refers to identity verification for individuals, while KYB (Know Your Business) applies to company verification. These processes confirm that a person or business is genuinely who they claim to be, using official documents and automated verification methods.

These checks are essential to:

- Prevent identity theft and document fraud

- Comply with legal requirements related to customer due diligence (KYC) and anti-money laundering (AML/CFT) regulations

- Secure online contractual and business relationships

- Protect your company from fraud, payment defaults, and reputational damage

Each verification generates a secure audit trail, supporting compliance and strengthening customer trust.

-

We offer four identity verification solutions, adaptable to the risk level of each use case:

- Image identity verification: automated analysis of an identity document image (ID card, passport, driver’s license) to verify document quality, type, data consistency, and authenticity.

- Video identity verification: the user presents their identity document live via their smartphone camera, enabling enhanced verification and improved detection of forged or altered documents.

- Face match identity verification: in addition to video verification, biometric comparison between the user’s live-captured face and the photo on their identity document.

- Certified Identity Verification (PVID): This is an ANSSI-certified hybrid level of verification that combines automated facial recognition checks with human review, along with additional systematic controls carried out by specialized agents.

These methods can be combined to create tailored verification workflows.

-

Verify offers three solutions depending on the required level of assurance:

- Bank document verification: automated analysis of a bank account statement (RIB/IBAN document) to detect forgery and extract the account holder’s name and IBAN.

- SEPAmail (individuals only): direct verification with traditional French banks to confirm that the account is active and that the declared account holder’s name matches the bank’s records.

- Open Banking (individuals and businesses): the user securely connects to their bank to confirm the existence of the account and verify ownership.

-

Our solution combines advanced Optical Character Recognition (OCR) and Large Language Models (LLMs) to extract, structure, and validate document data, ensuring reliable and usable information while meeting compliance requirements.

A wide range of documents can be securely verified, including:

- Personal documents (Social security card or certificate, driver’s license, proof of address, etc.)

- Company documents (Company registration document, Business status document, etc.)

- Financial documents (bank account documents, tax notices, etc.)

-

Verify enables automated company verification based on its registration number (e.g., SIREN/SIRET in France).

Company registry verification

Using the company registration number, Yousign queries official sources to instantly confirm:

- The company’s legal existence and status (active, dissolved, etc.)

- The identity of its legal representatives

- The registered office address

- The company’s business activity

Verified data is structured and ready to be integrated into your workflows, eliminating manual data entry and reducing errors.

-

In addition to identity and company checks, Verify provides sanctions and politically exposed persons (PEP) screening to strengthen your AML/CFT compliance processes.

Watchlist screening is performed against international sanctions and watchlists, enabling you to identify high-risk profiles before entering into a business relationship.

Spend more time on admin doing business. Yousign takes care of the rest.

Want to learn more? Talk to one of our KYC/KYB experts.