When outdoor apparel company Patagonia publicly committed to donating 1% of sales to environmental causes in the 1980s (later formalizing this through co-founding 1% for the Planet in 2002), critics predicted financial disaster. Instead, the company's authentic sustainability commitment built such powerful customer loyalty that it now generates over $1 billion in annual revenue. This wasn't an isolated success story—it represented an early glimpse of a fundamental business truth reshaping markets today.

The financial case for sustainability has become irrefutable. Companies with strong ESG performance generate average annual returns of 12.9% compared to just 8.6% for lower-rated peers, according to a 2023 Kroll study analyzing over 13,000 businesses worldwide. Meanwhile, ESG-focused institutional investments are projected to reach $33.9 trillion by 2026, representing 21.5% of assets under management.

77% of consumers will quit brands who are guilty of greenwashing, while half of all U.S. consumers have already switched brands based on environmental, social and governance factors. This convergence of investor expectations, consumer demand, and regulatory requirements creates both unprecedented opportunity and significant risk for organisations navigating the sustainability transition.

This comprehensive guide explores how sustainable business practices drive profitability, provides practical ESG reporting strategies for 2026, and delivers actionable steps for building sustainability into your business model.

Brief Summary:

- ESG Framework: Environmental, Social, and Governance (ESG) criteria directly impact financial performance, with ESG leaders earning 50% higher returns (12.9% vs 8.6%) than laggards according to comprehensive industry analysis.

- Regulatory Expansion: The EU's CSRD now covers 50,000 companies; global sustainability regulations have increased by 155% over the past decade, making proactive compliance essential for market access.

- Financial Benefits: Sustainable investments deliver operational cost savings, enhanced brand reputation, improved talent retention, and preferential access to capital markets with favorable financing terms.

- 2026 Requirements: Mandatory ESG reporting includes materiality assessments, greenhouse gas emissions across Scopes 1-3, diversity metrics, governance structures, and third-party verification to combat greenwashing.

- Implementation Priority: Start with baseline assessment of current footprint, set SMART sustainability goals, assign board-level responsibility, and integrate digital tools for automated tracking and transparent reporting.

Understanding ESG and Sustainable Business Practices

Environmental, Social, and Governance (ESG) criteria represent a framework for evaluating how organisations manage risks and opportunities related to environmental stewardship, social responsibility, and ethical governance. Far from abstract ideals, these factors directly impact financial performance, operational resilience, and competitive positioning.

- The Environmental pillar examines carbon emissions and climate strategy, energy efficiency and renewable energy adoption, water usage and waste reduction, and circular economy practices.

- The Social pillar addresses employee welfare and labour practices, diversity and inclusion initiatives, community engagement and social impact, and supply chain responsibility.

- The Governance pillar focuses on board composition and executive accountability, business ethics and anti-corruption measures, risk management frameworks, and stakeholder engagement.

NB:

ESG isn't merely about compliance or reputation management—it's a risk mitigation and value creation framework that identifies material issues affecting long-term business sustainability and financial performance.

The Evolution Toward Mainstream Business Strategy

Sustainable business practices have transitioned from niche initiatives to core mainstream strategy. The vast majority of major global companies now publish comprehensive sustainability reports and set public climate targets, such as achieving net-zero emissions. This widespread adoption reflects a clear recognition that sustainability delivers measurable business benefits and long-term value.

Regulatory requirements are accelerating at a record pace, with the volume of global sustainability regulations more than doubling over the past decade. This rapid increase in legal oversight makes proactive adoption essential for any organisation looking to mitigate compliance risks and maintain market access.

The Financial Case: How Sustainability Drives Profitability

Direct Revenue and Cost Benefits

Sustainable business practices impact the bottom line through multiple channels:

- Revenue Growth – Organizations with strong sustainability performance attract a growing demographic of conscious consumers. Consumers are willing to spend an average of 9.7% more on sustainably produced or sourced goods, with studies showing premiums ranging up to 12% for sustainable products. Younger generations show particularly strong preferences for brands that align with their values.

- Operational Efficiency – Optimizing resources through energy efficient technologies and waste reduction delivers immediate cost savings. Adopting circular economy approaches not only reduces expenses but also builds long-term resilience against resource scarcity and price volatility.

- Risk Mitigation – Proactive management of environmental and social risks helps businesses avoid costly legal penalties and operational disruptions. As climate change events increasingly impact global supply chains, resilience planning has become a necessity for protecting the bottom line.

- Access to Capital – The vast majority of investors now view sustainability as a core component of business strategy. Companies with robust credentials in this area benefit from easier access to capital and more favorable financing terms, as business leaders increasingly recognize these factors as a competitive edge.

Long-Term Value Creation

Beyond immediate impacts, sustainability practices build enduring advantages:

- Brand Reputation – A vast majority of consumers demonstrate stronger customer loyalty to businesses that advocate for social or environmental issues. Strong sustainability commitments differentiate brands in crowded markets and build customer relationships that are more resistant to competitive pressure.

- Talent Attraction – Sustainability has become a primary driver for recruitment and retention, particularly among younger generations. More than 40% of Generation Z and Millennial workers plan to change jobs due to climate concerns, with many employees actively pushing their employers to adopt sustainable practices.

- Innovation Catalyst – Sustainability challenges drive innovation across products, processes, and business models. Solving these issues often leads to the discovery of new revenue streams and more efficient ways of operating while simultaneously reducing environmental impact.

- Performance Synergy – Research demonstrates that ESG leaders consistently outperform their lower-rated peers in financial returns, with top-rated companies earning approximately 50% higher returns than their lower-rated counterparts. Those that lead in both economic profit and environmental responsibility are significantly more likely to achieve high annual revenue growth compared to their peers.

2026 ESG Reporting: Requirements and Best Practices

The Evolving Regulatory Landscape

ESG reporting requirements have expanded dramatically:

- European Leadership: The EU's Corporate Sustainability Reporting Directive (CSRD) expanded mandatory sustainability reporting, with almost 50,000 EU-based companies now subject to requirements. The directive emphasises double materiality—assessing both how sustainability issues affect companies and how companies impact society.

- Global Standards: The International Sustainability Standards Board (ISSB) has established baseline global sustainability standards, whilst regulatory developments in the US and UK signal convergence toward mandatory ESG transparency.

Essential Components of Effective ESG Reporting

Quality ESG reporting in 2026 must address multiple stakeholder needs:

- Materiality Assessment: Identify which ESG issues significantly impact your business and which business activities significantly impact society or environment. Focus reporting on material issues rather than attempting comprehensive coverage.

- Quantitative Metrics: Provide concrete data including greenhouse gas emissions across Scopes 1, 2, and 3, diversity metrics and employee satisfaction, board composition and governance structures, and supply chain sustainability indicators.

- Qualitative Context: Explain sustainability strategy and objectives, describe governance structures and accountability, detail implementation approaches, and acknowledge challenges whilst demonstrating commitment to continuous improvement.

- Third-Party Verification: Independent assurance enhances credibility and addresses greenwashing concerns. 87% of investors suspect corporate disclosures contain some greenwashing, making external verification increasingly essential.

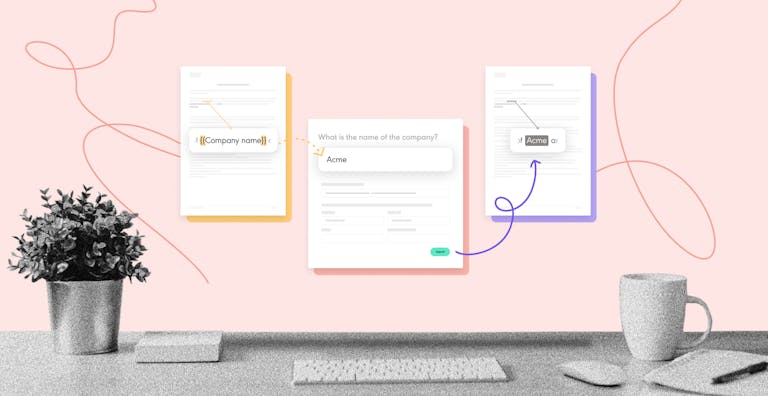

Streamline Your ESG Documentation with Secure Digital Workflows

Effective ESG reporting requires robust governance and audit trails. From sustainability reports to supplier agreements, Yousign's electronic signature platform ensures:

- Paperless contract management reducing environmental footprint

- Comprehensive digital audit trails for compliance verification

- Secure document workflows meeting governance standards

- Automated tracking reducing manual reporting inefficiencies

Implementing Sustainable Business Practices: A Practical Guide

Getting Started: Foundation-Building Steps

- Conduct Baseline Assessment: Evaluate current environmental footprint, social impact, and governance practices. Identify quick wins delivering immediate benefits alongside longer-term strategic initiatives.

- Engage Stakeholders: Consult employees, customers, investors, and community members about sustainability priorities. Stakeholder input ensures your strategy addresses material concerns whilst building implementation support.

- Set Clear Objectives: Establish specific, measurable, achievable, relevant, and time-bound (SMART) sustainability goals aligned with business strategy.

- Assign Responsibility: Designate clear ownership for sustainability strategy at board or senior management level with authority and resources to drive meaningful change.

Priority Areas for Business Sustainability

- Energy and Carbon Management: Implement energy efficient measures, transition to renewable energy sources, measure and reduce carbon emissions, and develop credible net-zero strategies.

- Supply Chain Sustainability: Assess supplier ESG performance, establish sustainability requirements in procurement contracts, build supply chain transparency, and develop resilience against climate and social risks.

- Circular Economy Principles: Design products for longevity and repairability, implement take-back and recycling programmes, reduce packaging waste, and explore product-as-service models.

- Social Responsibility: Ensure fair labour practices, promote diversity and inclusion, engage with local communities, and respect human rights throughout operations.

The digital transformation required for effective ESG reporting often reveals operational inefficiencies and automation opportunities delivering benefits beyond sustainability goals.

Measuring and Communicating Progress

- Establish KPIs: Define key performance indicators aligned with sustainability objectives. Common metrics include carbon intensity, waste diversion rates, employee diversity percentages, and supplier audit completion rates.

- Regular Monitoring: Implement systems for tracking progress against targets. Quarterly reviews enable course corrections whilst annual reporting provides comprehensive stakeholder updates.

- Transparent Communication: Share both successes and challenges authentically. Stakeholders value honesty about sustainability journeys over perfection, with transparency building trust that greenwashing destroys.

The workflow automation available through modern digital platforms can streamline sustainability reporting whilst reducing paper consumption and operational inefficiencies.

Overcoming Common Implementation Challenges

- Resource Constraints: Prioritise high-impact, low-cost measures first. Many energy efficient and waste reduction initiatives deliver positive ROI whilst building momentum. Leverage free resources from government programmes and industry associations.

- Data Collection: Implement digital systems for automated data collection. AI-augmented analytics and reporting tools are quickly proving their worth, with major technology providers launching carbon footprint and sustainability analytics platforms.

- Avoiding Greenwashing: Back all claims with verifiable data, obtain third-party verification, use precise language avoiding vague sustainability buzzwords, and acknowledge limitations whilst demonstrating genuine commitment. The EU Green Claims Directive increasingly penalises misleading environmental claims.

Frequently Asked Questions About Sustainable Business Practices

How quickly can businesses see financial returns from sustainability investments?

Timelines vary by initiative. Operational efficiency measures like energy reduction often deliver immediate cost savings, whilst brand reputation benefits build over 1-3 years. A majority of CEOs surveyed expect sustainability initiatives to generate significant profitability within 3-5 years, with 56% of global CEOs having personal compensation linked to sustainability metrics.

Do customers really care about sustainability?

Yes. 77% of consumers will abandon brands guilty of greenwashing, while half of U.S. consumers have already switched brands based on ESG factors. However, buyers are becoming more discerning, actively distinguishing genuine commitment from superficial marketing.

What ESG reporting frameworks should SMEs follow?

Start with frameworks relevant to your industry and stakeholders. The Global Reporting Initiative (GRI) provides comprehensive standards, whilst the Sustainability Accounting Standards Board (SASB) focuses on financially material issues. The ISSB standards offer global baseline requirements.

How can small businesses compete with large corporations on sustainability?

SMEs offer agility advantages enabling faster implementation. Focus on authentic commitment to issues material to your business rather than competing on scope. Many customers value genuine SME sustainability efforts over perfunctory large corporate programmes.

What role does technology play in ESG reporting?

AI and automation dramatically simplify sustainability measurement and reporting. Digital technologies enable real-time carbon footprint tracking, automated supply chain monitoring, and streamlined compliance reporting, democratising sophisticated ESG capabilities.

The Future of Sustainable Business

The sustainability landscape continues evolving rapidly, with several trends shaping 2026 and beyond:

- Regulatory Intensification: Mandatory ESG disclosure requirements expand globally, with penalties for non-compliance increasing significantly. Proactive businesses stay ahead of regulatory curves rather than reacting to compliance deadlines.

- Technology Integration: Artificial intelligence and blockchain enhance ESG data quality, transparency, and verification. Real-time sustainability monitoring replaces annual reporting cycles.

- Circular Economy Mainstreaming: Product lifecycle approaches shift to repair, reuse, and recycling models. This circularity becomes integral to ESG metrics, with businesses expected to demonstrate concrete implementation.

- Stakeholder Capitalism: Business purpose expands beyond shareholder value to encompass broader stakeholder interests, reinforcing ESG integration into core strategy.

Conclusion

Sustainable business practices have evolved from voluntary initiatives to essential business strategy. The convergence of regulatory pressure, investor expectations, and consumer demand makes ESG integration a competitive necessity rather than an optional add-on. Companies that proactively embed sustainability into operations, reporting, and governance structures position themselves for long-term success while those that delay face mounting compliance costs and reputational risks.

The 2026 ESG reporting landscape demands precision, transparency, and verifiable data. By following the framework outlined in this guide—from baseline assessments to stakeholder engagement, strategic goal-setting to automated measurement—organisations can transform sustainability from a compliance burden into a source of operational efficiency, innovation, and competitive advantage.

Ready to Align Your Business Processes with Sustainability Goals?

Digital transformation eliminates paper-based processes