A mere 1% improvement in price optimization can result in an 11.1% profit increase, yet pricing remains one of the most neglected levers for business growth. Research shows that companies realize less than half the amount of their price increases on average, leaving enormous value on the table.

The stakes have risen significantly. With 86% of finance chiefs saying pricing will become more important to organizational financial performance over the next 12 months, mastering pricing strategy is no longer optional—it's essential for competitive survival and growth.

This comprehensive guide explores proven pricing strategies, implementation frameworks, and practical insights for setting prices that drive growth whilst maximizing profitability.

Brief summary:

- Strategic leverage: Pricing is the highest-impact profit lever - a 1% optimization can boost profits by 11.1%, yet most companies leave money on the table by undervaluing this strategic tool.

- Six core strategies: Cost-plus pricing (simple, cost-recovery), value-based pricing (maximum profit potential), competitive pricing (market-relative), dynamic pricing (real-time adjustment), tiered pricing (multi-segment capture), usage-based pricing (consumption-aligned) - each suits different business models and growth stages.

- Psychology matters: Customers evaluate prices through anchoring, reference points, and value perception - understanding these cognitive biases is essential for effective pricing communication.

- Implementation over planning: 86% of CFOs recognize pricing's growing importance, but execution remains challenging - companies realize less than half of planned price increases on average due to competitive pressure and poor execution.

- Testing and iteration: Fast-growing companies treat pricing as a dynamic capability requiring continuous A/B testing, customer feedback loops, and data-driven refinement rather than annual reviews.

The Foundation: Understanding Pricing Strategy

Pricing strategy is the systematic approach to determining the optimal price for products or services based on market conditions, customer value perception, competitive positioning, and business objectives. Far from simple cost arithmetic, effective pricing strategy balances multiple factors to achieve specific business goals.

Pricing communicates value to customers, positions your brand in the marketplace, influences purchasing decisions, and directly impacts profitability. Every pricing decision sends signals about quality, target market, and competitive positioning.

NB:

Pricing isn't merely about covering costs—it's a strategic tool for growth. Leading companies treat pricing power as both core capability and C-level responsibility rather than delegating it to operational functions.

The Psychology of Pricing

- Customer price perception involves complex psychological factors that shape purchasing decisions and willingness to pay. Understanding these cognitive mechanisms enables businesses to set prices that maximize both conversion and revenue.

- Reference Pricing operates as a mental benchmark against which customers evaluate your offer. They compare your price against competitor prices, historical prices they've paid previously, and their perceived value of similar solutions. Strategic pricing leverages these reference points by anchoring customers to higher-value alternatives before presenting your standard offering.

- Value perception creates a delicate balance: price itself communicates quality signals. Set prices too low and you risk suggesting inferior quality or triggering skepticism about your product's capabilities. Price too high without corresponding value perception and you deter purchases entirely. The optimal price balances these perceptions by aligning cost with the tangible and intangible benefits customers receive.

- Price elasticity measures how demand responds to price changes, enabling strategic decisions about increases, discounts, and promotional pricing. Understanding your product's elasticity reveals whether customers are price-sensitive (elastic demand) or relatively insensitive to price fluctuations (inelastic demand), fundamentally shaping your pricing strategy.

- Anchoring effects demonstrate that initial price exposure creates powerful reference points influencing subsequent perceptions. Presenting premium options first makes standard options seem more reasonable and accessible. This psychological principle explains why tiered pricing models typically display highest-tier options prominently—they anchor customers to higher value points.

Good to know:

Fast-growing companies are twice as likely to use usage-based pricing models compared to slower-growth peers, demonstrating how strategic pricing innovation drives competitive advantage.

Common Pricing Strategies: Overview and Applications

Cost-Plus Pricing

- How It Works: Cost-plus pricing calculates total production costs (materials, labour, overhead) and adds a target profit margin. For example, if production costs £50 and your desired margin is 40%, the selling price becomes £70. This straightforward calculation ensures cost recovery and predictable margins.

- Best For: Manufacturing businesses with predictable costs, commodity products with standardized pricing, and businesses in stable markets with transparent cost structures. Industries with established cost-based pricing norms particularly benefit from this approach.

- Advantages: The primary appeal lies in simplicity—cost-plus pricing is easy to calculate and implement, ensures cost recovery with every sale, provides straightforward justification to stakeholders, and delivers predictable profit margins that simplify financial forecasting.

- Limitations: However, cost-plus pricing ignores customer value perception entirely, disregards competitive positioning in the market, doesn't optimize for maximum profitability potential, and fails to account for market demand fluctuations that might support higher prices.

Value-Based Pricing

- How It Works: Value-based pricing sets prices based on perceived customer value rather than production costs. This approach requires researching customer willingness to pay, quantifying the value your product or service delivers to their business, and pricing accordingly to capture maximum value.

- Best For: Unique products with clear differentiation, professional services where expertise commands premiums, and software solutions delivering measurable business outcomes. Value-based pricing excels when customers can quantify ROI from your offering.

- Advantages: Value-based pricing captures maximum value from each transaction, aligns price directly with customer benefits, enables premium positioning in the market, and supports higher profit margins than cost-oriented approaches.

- Limitations: This strategy requires deep customer understanding through ongoing research, proves harder to implement initially than simpler methods, needs continuous market research to maintain accuracy, and varies significantly across customer segments requiring tailored approaches.

The contract negotiation processes businesses implement should reflect pricing strategy, ensuring value propositions translate into mutually beneficial agreements.

Competitive Pricing

- How It Works: Competitive pricing sets prices relative to competitors—matching, undercutting, or positioning at premium levels. This approach involves monitoring competitor pricing continuously and adjusting your prices accordingly to maintain desired market position.

- Best For: Commoditized products with little differentiation, highly competitive markets with price-sensitive customers, and market entry situations requiring rapid share gain. When product features are largely standardized, competitive pricing provides clear market signals.

- Advantages: Competitive pricing maintains competitive parity with market leaders, reduces pricing risk by following established benchmarks, simplifies communication to stakeholders, and responds quickly to market changes.

- Limitations: This strategy ignores your unique value proposition, risks triggering price wars that destroy industry profitability, compresses margins over time through continuous undercutting, and makes differentiation increasingly difficult as price becomes the primary competitive factor.

Important:

Competing solely on price is rarely sustainable. A 2025 Simon-Kucher study found that companies realize less than half the amount of their planned price increases on average—often due to competitive pressure forcing concessions. Focus on value differentiation alongside competitive positioning to maintain pricing power.

Dynamic Pricing

- How It Works: Dynamic pricing adjusts prices based on real-time market conditions including demand fluctuations, inventory levels, customer segments, and competitive actions. Sophisticated algorithms continuously optimize prices to maximize revenue across varying conditions.

- Best For: Digital products with zero marginal costs, businesses with perishable inventory (travel, events, hospitality), and companies with sophisticated pricing technology infrastructure capable of real-time adjustments.

- Advantages: Dynamic pricing maximizes revenue across diverse conditions, responds to demand in real-time to capture optimal value, optimizes inventory management by clearing excess stock, and enables price discrimination across customer segments to capture varying willingness to pay.

- Limitations: This approach requires sophisticated technology investment, can frustrate customers with price variability creating distrust, risks perception of unfairness particularly in consumer markets, and needs careful regulatory compliance as some jurisdictions restrict certain dynamic pricing practices.

Attention:

Dynamic pricing requires careful regulatory compliance, especially in B2C contexts. Several jurisdictions prohibit discriminatory pricing based on customer characteristics. Always consult legal counsel before implementing AI-driven or customer-segmented pricing algorithms.

Tiered Pricing

- How It Works: Tiered pricing offers multiple product versions at different price points (good, better, best), allowing customers to self-select based on needs and budgets. Each tier provides progressively more features, capacity, or support, creating clear upgrade paths.

- Best For: SaaS and subscription businesses, professional services with varying service levels, and products with easily distinguishable feature sets. Tiered pricing excels when customer needs vary significantly across segments.

- Advantages: Tiered pricing captures different customer segments simultaneously, encourages upselling naturally as customers grow, provides clear upgrade paths that drive expansion revenue, and maximizes market coverage by addressing diverse budgets.

- Limitations: Too many options can confuse customers creating decision paralysis, requires careful tier design to prevent cannibalization, risks lower-tier options attracting customers who would pay more, and complicates product development by maintaining multiple feature sets.

Good to know:

The "Rule of Three" in tiered pricing psychology is powerful: offering exactly three tiers (Basic, Professional, Enterprise) maximizes conversion whilst minimizing choice paralysis. Research shows that adding a fourth tier typically reduces overall revenue as customers overthink decisions.

Usage-Based Pricing

- How It Works: Usage-based pricing charges customers based on actual product or service consumption—volume used, features accessed, or resources consumed. Pricing scales proportionally with customer usage, creating direct alignment between cost and value received.

- Best For: Infrastructure and platform services, businesses with variable customer usage patterns, and products where value correlates directly with consumption. Cloud services, API platforms, and data processing exemplify natural fits for usage-based models.

- Advantages: Usage-based pricing aligns cost with value received creating fairness perception, lowers barriers to entry with minimal upfront commitment, scales naturally with customer growth maximizing expansion revenue, and creates transparency that builds trust.

- Limitations: Revenue becomes less predictable complicating financial forecasting, requires robust usage tracking infrastructure, can be complex to explain to customers unfamiliar with consumption-based models, and makes budgeting difficult for customers preferring fixed costs.

Pricing Strategy Comparison: Which Approach Fits Your Business?

Strategy | Ideal For | Implementation Complexity | Profit Potential | Main Risk |

|---|---|---|---|---|

Cost-Plus | Manufacturing, stable markets, commodities | Low (simple calculation) | Moderate | Ignores customer value perception |

Value-Based | Differentiated products, B2B services, software | High (requires customer research) | Very High | Difficult to quantify value consistently |

Competitive | Commoditized markets, market entry | Low (follow competitors) | Low-Moderate | Price wars, margin erosion |

Dynamic | Digital products, perishable inventory | Very High (requires technology) | Very High | Customer frustration, perceived unfairness |

Tiered | SaaS, subscriptions, multiple segments | Moderate (tier design crucial) | High | Cannibalization between tiers |

Usage-Based | Infrastructure, platforms, variable usage | Moderate (tracking required) | High | Revenue unpredictability |

Factors Influencing Pricing Decisions

Market and Competitive Factors

Your market positioning—whether premium, mid-market, or value-focused—fundamentally shapes pricing possibilities. Each position requires different pricing strategies and communication approaches. Premium brands leverage quality perception to justify higher prices, mid-market players balance value and accessibility, whilst value positions compete on affordability without sacrificing essential features.

The competitive landscape directly impacts your pricing freedom. The number, strength, and pricing of competitors constrains or expands your options. Monopolistic situations allow significant pricing flexibility, whilst commoditized markets with numerous competitors severely constrain pricing power. Understanding your competitive position reveals how much pricing autonomy you possess.

Market conditions including inflation, consumer confidence, and purchasing power affect pricing decisions profoundly. Businesses must balance maintaining margins with customer affordability. Economic downturns may necessitate value-oriented adjustments, whilst growth periods support premium pricing strategies.

Supply and demand dynamics create natural pricing signals. Scarcity enables premium pricing as customers compete for limited availability, whilst oversupply pressures prices downward as businesses compete for customers. Understanding these market forces informs optimal pricing timing and levels.

Customer Factors

Customer segmentation reveals that different segments value products differently and exhibit varying price sensitivities. B2B customers often pay premiums for reliability, security, and dedicated support, whilst price-conscious consumers prioritize affordability above ancillary features. Effective pricing strategies acknowledge these differences through segmented approaches.

Purchase frequency influences appropriate pricing models significantly. One-time purchases allow different strategies than recurring subscriptions. Subscription businesses optimize for lifetime value rather than transaction maximization, focusing on retention and expansion revenue over initial acquisition pricing.

Price sensitivity, measured through elasticity, reveals how demand changes with price adjustments. Understanding elasticity enables informed decisions about increases, promotions, and discount strategies. Inelastic products tolerate price increases with minimal volume loss, whilst elastic products require careful pricing to avoid demand destruction.

Customer acquisition costs (CAC) must be factored into pricing to ensure profitability. High CAC businesses need higher prices or focus on lifetime value optimization. The customer acquisition strategies businesses implement must align with pricing to ensure sustainable unit economics.

Internal Business Factors

Your cost structure—the ratio of fixed to variable costs—influences pricing flexibility profoundly. High fixed-cost businesses benefit from volume pricing that spreads overhead across more units, reducing per-unit costs. Variable-cost businesses can price closer to margins with less risk since costs scale proportionally with volume.

Business stage dictates appropriate pricing approaches. Startups might price for market penetration or validation, accepting lower margins to prove product-market fit. Growth-stage companies optimize for expansion and market share capture. Mature businesses focus on profit optimization and margin defense, having established market position.

Strategic objectives determine which pricing approach aligns with goals. Are you prioritizing market share, profitability, or brand positioning? Market share strategies require aggressive pricing, profitability goals demand margin optimization, whilst premium positioning necessitates value-based approaches. Each objective requires fundamentally different pricing execution.

Operational capacity must inform pricing decisions practically. Selling below capacity might warrant aggressive pricing to drive volume utilization, whilst operating at or near capacity justifies premium pricing and selective customer acceptance to maximize per-unit revenue.

Implementing and Optimizing Your Pricing Strategy

Developing Your Pricing Strategy

Conduct comprehensive market research to understand customer willingness to pay through surveys, interviews, competitive analysis, and conjoint analysis revealing feature valuations. This research foundation ensures pricing decisions are grounded in market reality rather than internal assumptions.

Calculate costs accurately including direct production costs, allocated overhead, customer acquisition costs, and ongoing support expenses. Knowing your true costs establishes the floor below which pricing becomes unprofitable, whilst revealing opportunities where value significantly exceeds cost.

Define your value proposition clearly by articulating what unique value you deliver, how it differs from competitors, what problems you solve, and what measurable outcomes customers achieve. This clarity enables value-based pricing approaches and supports premium positioning.

Select your primary strategy by choosing the pricing model best aligned with your business model, market position, competitive landscape, and strategic objectives. Most successful businesses employ hybrid approaches, combining elements of multiple strategies tailored to their unique circumstances.

Design your pricing structure by determining specific price points, tier structures if applicable, discount policies, and payment terms. This structure should simplify customer decision-making whilst maximizing revenue potential across segments.

Checklist: Your Pricing Strategy Development Checklist

- Market research: Survey 20+ customers about willingness-to-pay across feature sets

- Cost analysis: Calculate true fully-loaded cost per unit including overhead allocation

- Competitor mapping: Analyze pricing of top 5 competitors and their positioning

- Value quantification: Document measurable outcomes customers achieve with your product

- Pricing model selection: Choose primary strategy aligned with business model and objectives

- Testing plan: Design A/B tests for 2-3 price points or tier configurations

- Communication strategy: Draft customer-facing pricing explanations and justifications

Testing and Refining Pricing

A/B testing enables experimentation with different price points across customer segments. Digital businesses can test pricing variations systematically before full rollout, measuring conversion rates, customer feedback, and revenue impact to identify optimal pricing. This data-driven approach reduces the risk of pricing missteps whilst revealing opportunities invisible through analysis alone.

Monitor key metrics continuously including conversion rates at different price points, average revenue per customer, customer lifetime value, and price elasticity indicators. These metrics reveal whether pricing changes achieve desired outcomes or require adjustment. Dashboard tracking ensures real-time visibility into pricing performance, enabling rapid course correction.

Gather customer feedback regularly by surveying customers about pricing perceptions, value received, and willingness to pay for additional features or services. This qualitative insight complements quantitative metrics, revealing the "why" behind behavioral patterns. Direct conversations with customers often uncover value perceptions that data alone cannot capture.

Competitive monitoring tracks competitor pricing changes, new entrant pricing strategies, and market pricing trends continuously. This intelligence reveals market movements requiring responsive adjustments to maintain competitive position. Automated tools can alert your team to significant competitive shifts, ensuring you never fall behind market dynamics.

Iterative adjustment recognizes that pricing optimization is ongoing. Fast-growing companies view pricing as a strategic lever requiring continuous refinement rather than set-and-forget decisions. The workflow automation businesses implement can streamline pricing approvals, quote generation, and contract execution for consistency and efficiency.

Communicating Price Changes

Transparent communication about price increases explains changes clearly, emphasizing value enhancements, cost pressures necessitating adjustments, and providing advance notice allowing customers adjustment time. Honesty builds trust even when delivering unwelcome news. The most successful price increase communications frame changes as investments in continued quality rather than extraction.

Value reinforcement accompanies price increases by simultaneously highlighting improvements including new features, enhanced support, or expanded capabilities. This frames increases as investments in continued quality rather than pure extraction, making them more palatable. According to the Deloitte Q3 2025 CFO Signals survey, 95% of companies have already changed their pricing strategies over the past six months, demonstrating the need for proactive adaptation.

Grandfathering strategies consider protecting existing customers temporarily whilst applying new pricing to new customers. This approach builds loyalty whilst optimizing revenue, though it creates pricing complexity and eventual pressure to unify pricing tiers. The decision to grandfather depends on customer concentration, churn risk, and competitive dynamics.

Timing considerations align price changes with value additions when possible, avoid changes during customer busy seasons, and provide adequate notice periods. Strategic timing minimizes disruption and maximizes acceptance. B2B customers particularly appreciate 60-90 days notice to adjust budgets and secure internal approvals.

Common Pricing Mistakes to Avoid

Pricing too low leaves money on the table, signals low quality to prospects, attracts price-sensitive customers with high churn rates, and makes future increases difficult as customers anchor to initial low prices. Many businesses systematically underprice from misplaced fear of customer rejection, sacrificing profitability unnecessarily. The psychological impact of underpricing often proves more damaging than the immediate revenue loss.

Failing to raise prices despite rising costs, increased value delivery, or market changes erodes margins silently. Regular pricing reviews prevent margin erosion, yet many businesses avoid increases from inertia or discomfort. Strategic pricing requires proactive adjustments aligned with cost and value evolution. Annual pricing reviews should be mandatory calendar events, not discretionary activities.

Ignoring customer segments through one-size-fits-all pricing fails to capture value from customers willing to pay more whilst excluding price-sensitive prospects. Segmentation maximizes market coverage, yet many businesses default to single pricing from simplicity. Tiered or segment-specific pricing dramatically improves revenue potential by acknowledging that different customers derive different value from identical offerings.

Competing solely on price destroys industry profitability through perpetual undercutting. Price wars rarely produce winners as margins compress industry-wide. Sustainable competitive advantages stem from differentiation—unique features, superior service, or specialized expertise—not lowest prices. Once a price war begins, recovery proves extraordinarily difficult.

Complex pricing structures confuse customers, increase sales friction, and complicate internal management. Overly complicated pricing with numerous tiers, add-ons, and special conditions overwhelms customers creating decision paralysis. Simplicity aids decision-making and accelerates conversion. If your sales team requires extensive training to explain pricing, it's too complex for customers to understand quickly.

Not tracking pricing impact makes optimization impossible. Without measuring how pricing affects conversion, revenue, and profitability, businesses operate blindly. Data-driven pricing requires robust analytics revealing which pricing strategies succeed and which require adjustment. Modern pricing management demands the same analytical rigor as product development or marketing campaigns.

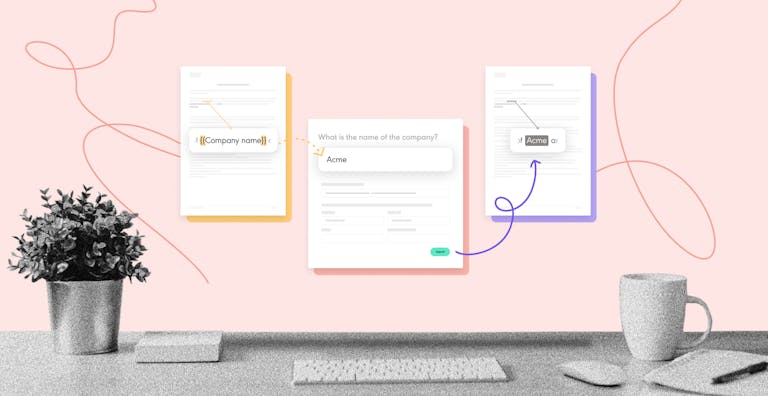

From Pricing Strategy to Revenue Realization: The Contract Automation Advantage

Your meticulously crafted pricing strategy faces a critical bottleneck: the gap between price agreement and revenue collection. B2B sales cycles average 134 days (2023 data), with contract negotiation and signature processes accounting for significant delays. When market conditions demand rapid pricing adjustments—as 86% of CFOs anticipate over the next 12 months—slow contract execution erodes competitive advantage.

Electronic signature platforms remove this friction by accelerating the quote-to-cash cycle:

Instant pricing implementation enables contracts to be signed and executed within hours rather than days or weeks when customers accept quotes. This speed allows you to capture revenue at optimal pricing points before market conditions shift, particularly critical during competitive situations or time-sensitive opportunities. Every day of delay represents revenue at risk and potential competitive encroachment.

Automated approval workflows route complex pricing scenarios—custom tiers, volume discounts, enterprise negotiations—through predefined approval chains without manual bottlenecks. This ensures consistency whilst maintaining control, preventing unauthorized discounting whilst accelerating legitimate deals. Clear audit trails document every approval decision, supporting compliance whilst enabling rapid deal progression.

Audit trails for compliance provide complete documentation of pricing agreements, terms acceptance, and signature timestamps. This documentation meets accounting standards for revenue recognition whilst protecting against disputes, particularly valuable when pricing complexity increases. Regulatory requirements around revenue recognition demand documentation that manual processes struggle to maintain consistently.

Billing system integration creates seamless connection between signed contracts and payment initiation, eliminating manual handoffs that delay cash collection. When pricing and payment flow automatically from signature, revenue realization accelerates measurably. Integration with ERP and accounting systems ensures pricing execution translates immediately into financial recognition.

Yousign's electronic signature platform is trusted by thousands of businesses across Europe to accelerate their quote-to-cash cycle. Pricing power means nothing if you can't convert decisions into revenue quickly. From initial quotes to contract signing and payment, Yousign ensures your carefully crafted pricing strategy translates efficiently into realized revenue.

Accelerate Your Pricing Execution

Turn pricing decisions into revenue 7 days faster with Yousign's electronic signature platform. Reduce contract cycles from weeks to hours.

Frequently Asked Questions About Pricing Strategy

How often should I review my pricing strategy?

Review pricing at least annually, with quarterly checks for fast-changing markets. Monitor key metrics continuously, adjusting when significant market shifts, cost changes, or competitive actions occur. Fast-growing companies treat pricing as a dynamic strategic lever requiring ongoing refinement rather than annual set-and-forget decisions.

Should startups price low to gain market share?

Not necessarily. Whilst penetration pricing can accelerate adoption, it attracts price-sensitive customers with high churn, establishes low-price expectations making increases difficult, and may signal low quality. Many successful startups price at premium levels, using product uniqueness and quality as differentiation instead of competing on price.

How do I justify price increases to existing customers?

Communicate transparently about value enhancements, cost pressures, or market changes. Highlight improvements customers receive (new features, expanded capabilities, enhanced support), provide advance notice (30-60 days minimum), and consider grandfather periods for loyal customers. Frame increases as investments in continued quality and innovation rather than pure profit extraction.

What's the best pricing strategy for a new product?

It depends on your objectives. Penetration pricing (low initial prices) builds market share quickly but risks undervaluing your product. Price skimming (high initial prices) maximizes early profits from innovators. Value-based pricing aligns with customer benefits and typically delivers best long-term results. Most importantly, ensure pricing covers costs whilst reflecting your strategic positioning and target market.

The Future of Pricing Strategy

Pricing strategy continues evolving with technological and market developments shaping tomorrow's approaches.

AI-powered pricing enables real-time pricing optimization based on demand patterns, competitive actions, and customer behavior. Artificial intelligence analyzes vast datasets identifying optimal price points across conditions faster than human analysis. Organizations implementing AI-powered pricing are projected to increase profitability by substantial margins as algorithms continuously optimize. The transition from reactive to predictive pricing represents a fundamental shift in competitive dynamics.

Outcome-based pricing increasingly ties pricing directly to measurable business outcomes delivered rather than inputs consumed. This approach requires sophisticated tracking and greater vendor-customer alignment, but creates powerful incentive alignment. Customers pay for results achieved, whilst vendors demonstrate tangible value delivery. This model particularly resonates in professional services, software, and consulting where impact measurement is feasible.

Ecosystem pricing emerges as business ecosystems become interconnected. Pricing strategies increasingly account for platform integrations and partnerships, rewarding customers for using multiple ecosystem tools. This approach recognizes that value extends beyond individual products to comprehensive solutions. Companies like Salesforce demonstrate ecosystem pricing success by creating value that exceeds the sum of individual component prices.

Personalized pricing leverages advanced data analytics enabling individualized pricing based on customer characteristics, usage patterns, and willingness to pay. Whilst maintaining fairness perceptions proves challenging, personalization potentially maximizes revenue by optimizing prices for each customer relationship. B2B contexts offer more latitude for personalization than B2C, where regulatory scrutiny remains intense.

Sustainability integration sees customer experience and product support surpassing sustainability as top factors influencing willingness to pay. However, integrating sustainability into broader value propositions justifies premium pricing for environmentally-conscious segments. Forward-thinking businesses embed sustainability naturally rather than charging explicit premiums, recognizing that sustainability represents table stakes rather than premium differentiators.

The most successful businesses will view pricing as dynamic strategic capability requiring continuous innovation, sophisticated analytics, and executive-level attention rather than operational afterthought. Pricing excellence increasingly separates market leaders from laggards. As market volatility accelerates, pricing agility becomes a defining competitive advantage.

Ready to Transform Your Pricing Into Revenue?

Discover how Yousign's electronic signature platform can reduce time-to-revenue whilst maintaining comprehensive financial controls.