While electronic signatures are expanding in all sectors, there are certain legal questions regarding its use by professionals and individuals.

- Is it possible to refuse an electronically signed document?

- Can you be forced to sign using an electronic signature?

Can you force your suppliers to sign their purchase orders electronically? Can your insurer refuse to allow you to sign its policy electronically on the grounds that the signature is not valid?

We will try to answer these questions in as much detail as possible so that you can make good use of your electronic signature tools.

Can you be forced to sign with an electronic signature?

What does the law say?

UNCITRAL (United Nations Commission on International Trade Law) states in its Model Law on Electronic Signatures (2001) which served as a model for the European eIDAS Regulation, that each party to a contract remains free as to the form of the contract and the method of signing it, provided of course that they comply with their national law on this matter.

The implementation of the electronic signature is therefore “not meant to affect contractual freedom”.

These principles of party autonomy and contractual freedom are enshrined in French law in Article 1102 of the French Civil Code. This states that everyone is free to contract or not to contract, to choose the person with whom to contract, and to determine the content and form of the contract, within the limits imposed by legislation.

The form of a contract must therefore be agreed upon by each party. Its digital form and the way it is signed cannot be imposed by any of the contracting parties, regardless of their position.

The UNCITRAL Model Law goes further by stating in Article 4.

“While the general purpose of the Model Law is to facilitate the use of electronic signatures, it should not be construed in any way as imposing their use.”

This notion of respect for party autonomy is further elaborated in the Guide to Enactment of the Model Law. States cannot therefore introduce binding legislation imposing electronic signatures, as this would run counter to the principle of party autonomy.

The use of a “durable medium”

First of all, what is a durable medium?

The EU Directive 2011/83/EU defines it as follows:

“Any instrument which enables the consumer or the trader to store information addressed personally to him in a way accessible for future reference for a period of time adequate for the purposes of the information and which allows the unchanged reproduction of the information stored.”

This durable medium, which concerns all digitised processes, is therefore contrasted with the traditional paper medium. Electronically signed contracts are therefore considered to be durable media.

In the framework of a contractual relationship with a consumer, you should check that the use of durable media is appropriate to their situation and therefore you cannot impose exchanges by digital means alone. This is why, for example, banks always ask for your consent before submitting documents, contracts, amendments and pre-contractual information to you by e-mail prior to your business relationship.

This applies to both face-to-face subscriptions and digital subscriptions.

This obligation appears in the French Monetary and Financial Code, the French Insurance Code, the French Consumer Code, the French Mutual Insurance Code and the French Social Security Code.

The one and only exception is subscription to an energy contract. A consumer is thus able to request that their service starts before the end of the withdrawal period laid down in the contract, provided that this request is made on a durable medium.

Let’s recap!

NO, electronic signatures are not mandatory. When you sign a contract, both parties must agree on the content and on its form, too. So you cannot force someone to sign a document electronically if they absolutely want to sign it by hand. You may not impose digital correspondence on them, let alone the electronic signing of contracts.

In this case, it will be up to you to explain to the signatories the advantages of an electronic signature!

We have prepared a toolkit for this purpose 😉

Why you should not refuse to sign electronically ?

The use of the electronic signature offers a whole host of advantages for you and for your customer, too.

A great time saver : No need to initial both sides of the 300 pages of your contracts and appendices. You just have to go through them and sign them using a code sent by SMS. There is also no need to travel: you can read and sign the document remotely!

Better service responsiveness: Subscription contracts are no longer sent by post and do not need to be meticulously rechecked. Digitisation also allows you to reduce the risk of misinterpretation related to indecipherable handwriting. Everything can be automated, and all services can be notified in real time. The processing time is therefore considerably reduced, allowing your customers to enjoy their new service immediately.

Reduced subscription costs: shorter processing times, no postal exchanges, no need for paper and printer cartridges, all of which allow you to reduce file administration costs and deliver direct benefits to your customers.

Increased security: digitised documents do not deteriorate over time. Digital storage allows your customers to make copies of their contracts on different media for backup and protection. Each copy will keep a record of the digital certificate associated with the individual signatories. Finally, Yousign archives an evidence file for each signature at Arkhineo, a third-party archiver, for 10 years.

Can I refuse an electronically signed document?

Can a document be refused and its legal value refuted on the pretext that it has been signed using an electronic signature system?

What does the law say?

In this case, the legislation differs for B2C and B2B relations.

The French Ordinance of 4 October 2017 specifies that a professional cannot refuse the use of an electronic signature process by a private customer in connection with a subscription to a contract. This ordinance amends all the above-mentioned Codes and therefore applies to all the business sectors concerned. However, this provision only benefits the consumer. You cannot therefore refuse a document signed electronically by your customer if said customer is a private individual.

For contracts between professionals, contractual freedom remains the rule and the two parties must therefore agree beforehand on the form of the contract and the way it is to be signed.

And in court?

In the event of a dispute, can the courts refuse to take into account an electronically signed document?

First of all, Article 1 of Decree No. 2017-1416 of 28 September 2017 on electronic signatures, which transcribes into French law elements of the European eIDAS Regulation, places the qualified electronic signature on the same level as the handwritten signature by presuming its reliability in the event of a dispute, unless there is proof to the contrary.

However, the implementation of a qualified electronic signature is particularly burdensome. It requires the signatory to be given a physical medium (smart card or cryptographic USB key), enabling the signatory to sign, by a representative of the certification authority, after their identity has been verified in person.

Let’s be honest, this system cannot be applied in practice to most of the uses we all make of the signature.

What about the validity of so-called simple and advanced signatures? In accordance with the principle of non-discrimination, UNCITRAL states in its Article 3 that “no method of electronic signature should be discriminated against”. This principle is taken up by Article 25 of the eIDAS Regulation, which states: “An electronic signature shall not be denied legal effect and admissibility as evidence in legal proceedings solely on the grounds that it is in an electronic form or that it does not meet the requirements for qualified electronic signature”.

These signatures are therefore perfectly admissible in court. However, you will need to opt for a particularly reliable solution using an electronic certificate and verifying the identity of the signatory and the integrity of the document.

A few exceptions

Almost all documents can now be signed using an electronic signature process. Article 1174 of the French Civil Code states that all authentic and private documents can be in paperless form. However, Article 1175 specifies that two categories of private documents are still exceptions.

- Private deeds relating to family and inheritance law.

This includes documents such as future protection mandates, civil partnerships, holographic wills and undivided co-ownership agreements relating to property.

- Private deeds relating to personal or real securities, of a civil or commercial nature, unless they are executed by a person for the purposes of their profession.

These are written personal security instruments, such as guarantee contracts, which require handwritten entries. This also includes written real securities documents, i.e. tangible pledges and collateral.

In this respect, the ELAN law of 23 November 2018 has abolished the handwritten entries that were previously mandatory in surety bonds for property leases. This development seems to pave the way for a complete digitisation of leases. However, Article 1775 of the French Civil Code has not been amended by this law. Although handwritten entries have been removed, it is still impossible to sign a surety bond electronically, as it is “a private signed document relating to personal or real securities”. This only applies where the signatory is a civil guarantor not acting for professional purposes, for example in connection with a lease for private accommodation. If the signatory is acting for professional purposes, they can sign the surety bond electronically.

Let’s recap!

In general, therefore, it is not possible to refuse to accept an electronically signed document on the grounds that it is not valid. The clarifications provided by the European eIDAS Regulation and its transposition into French law ensure its reliability in connection with a so-called qualified signature. The principle of non-discrimination also allows other electronic signature processes to be taken into account in judicial institutions, provided that the reliability of the process can be demonstrated and the integrity of the document can be ensured.

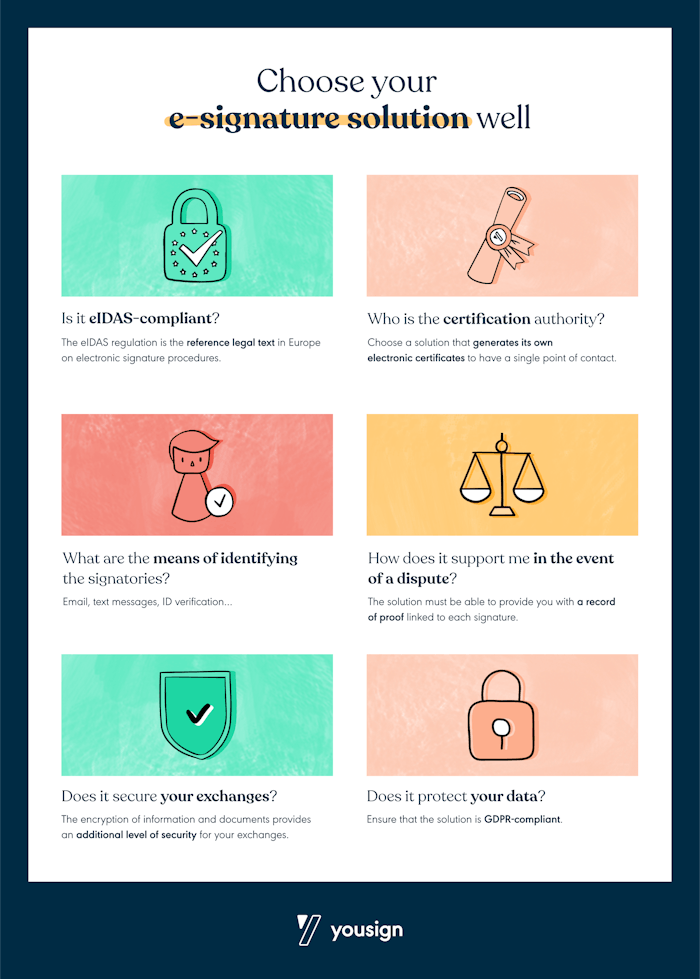

How do I know if my electronic signature solution is legally valid?

You will need to consider a number of criteria when choosing your electronic signature solution. However, the first thing you need to ensure is that it is reliable in the event of a dispute.

First, make sure that the solution is certified in France and Europe. It must comply with the eIDAS Regulation which sets out the rules for the use and legal recognition of electronic signature processes in the European Union. All certified solutions are displayed on the European Commission website.

You must ensure that a digital certificate generated by a certification authority such as Yousign is associated with each signatory of a document.

In order for an electronic signature procedure to be recognised as reliable, it must formally identify the signatory and ensure the integrity of the signed document.

You can identify the signatory in different ways, for example by using an SMS code or by checking their ID online. As regards the integrity of the document, the solution must ensure that any changes to the document made after the signature cancel the electronic certificate, effectively cancelling the validity of the altered document. Only the original version will have real legal value.

Finally, choose a solution that will be able to provide you with the necessary elements in the event of a dispute. For example, for each signature, Yousign provides you with an evidence file containing a range of elements for proving the identity of the signatory and the reliability of the electronic signature procedure carried out.

Take it to the next level

Try Yousign free for 14 days