Starting and scaling a business requires more than just a great idea—it demands adequate funding to fuel expansion, hire talent, invest in technology, and capture market opportunities. Finance business growth effectively, and you'll position your company for sustainable success. Choose the wrong financing approach, and you might find yourself struggling with cash flow or losing control of your vision.

Understanding the various capital injection options available and implementing best practices can make the difference between thriving development and financial strain. Whether you're a startup seeking initial capital or an established company planning expansion, this comprehensive guide will help you navigate the complex world of business financing.

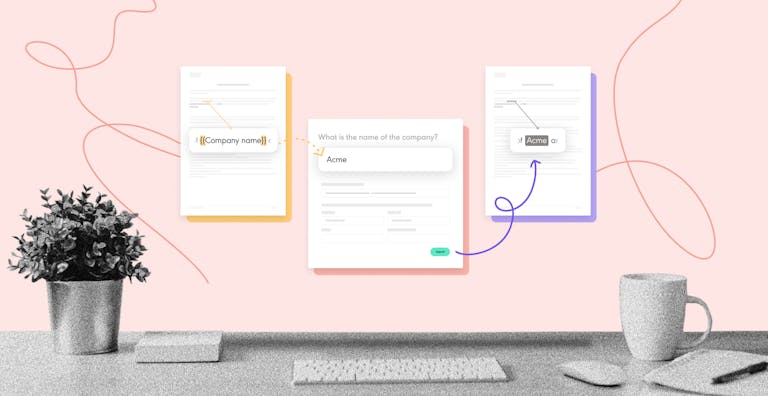

At Yousign, we understand that funding decisions often involve extensive documentation and contract negotiations. Our electronic signature solution streamlines these processes, allowing companies to close funding deals faster and more efficiently, whether you're signing loan agreements, investor contracts, or partnership deals.

Understanding Business Growth Financing Fundamentals

Business growth financing refers to the capital injection needed to expand operations, enter new markets, develop products, or scale existing services. Unlike maintenance funding that covers day-to-day operations, growth financing is specifically targeted at activities that will increase revenue, market share, or operational capacity.

NB:

Growth financing isn't just about getting money—it's about securing the right type of funding at the right time with conditions that align with your enterprise objectives.

The timing of financing is crucial. Seeking funding too early might mean giving up unnecessary equity or taking on debt before you can service it effectively. Waiting too long could mean missing expansion opportunities or running into cash flow problems during expansion.

Consider the case of many small organizations that experience the "growth trap"—they secure large contracts or experience rapid demand increases but lack the working capital to fulfill orders, hire staff, or purchase inventory. This is where strategic growth financing becomes essential.

Traditional Financing Options for Business Development

Bank Loans and Credit Lines

Traditional bank loans remain one of the most common funding methods for established firms. Banks typically offer term credits for specific projects and business overdrafts for ongoing working capital needs.

Good to know:

Banks generally prefer enterprises with at least two years of operating history, strong credit scores (typically 680+), and consistent cash flow. The application process can take 2-6 weeks, so plan accordingly.

Term loans work best for equipment purchases, real estate acquisitions, major expansion projects, and debt consolidation. Business overdrafts are ideal for seasonal cash flow fluctuations, inventory purchases, short-term working capital needs, and emergency funding access.

Government-Backed Lending and BBB Schemes

The British Business Bank works with commercial lenders to provide government-backed loan schemes, reducing risk and enabling better conditions for UK organizations. These schemes typically offer lower interest rates and more flexible terms than standard commercial credits.

Popular government-backed schemes include Start Up Loans for new firms up to £25,000, Recovery Loan Scheme for established organizations, and regional growth funds supporting specific sectors or areas.

Important:

Government-backed lending solutions require extensive documentation and can take 4-8 weeks to process, but the favorable clauses and reduced personal guarantees often make them worthwhile for qualifying UK firms.

Alternative Financing Solutions

Asset-Based Lending and Invoice Factoring

Asset based lending allows firms to borrow against their existing assets, including inventory, accounts receivable, equipment, or real estate. This option works particularly well for organizations with substantial assets but limited credit history.

Invoice factoring involves selling your accounts receivable to a factoring company at a discount, providing immediate cash flow rather than waiting 30-90 days for customer payments. This solution addresses one of the biggest challenges in cash flow management.

Financing Type | Speed | Typical Cost | Best For |

|---|---|---|---|

Asset-Based Lending | 2-4 weeks | 8-15% APR | Inventory-heavy businesses |

Invoice Factoring | 24-48 hours | 1-5% per month | B2B companies with strong receivables |

Equipment Financing | 1-2 weeks | 6-12% APR | Companies needing machinery/equipment |

Business Overdrafts | 1-2 weeks | 10-30% EAR | Working capital and cash flow management |

Venture Capital and Angel Investment

For high-development potential firms, venture capital funding and angel investors provide not just capital but also expertise, networks, and strategic guidance. Venture capitalists angel investors typically seek organizations with scalable models and the potential for significant returns.

Venture capital investments usually involve equity stakes in exchange for funding, board representation, strategic guidance and mentorship, network access and business connections, and follow-on funding potential.

Good to know:

While venture capital can provide substantial funding, it also means giving up ownership and some control over business decisions. Ensure alignment with investor expectations and timeline.

Try Yousign's electronic signature solution free for 14 days to streamline your financing documentation process.

Modern Financing Approaches

Revenue-based financing offers an alternative to traditional debt equity financing models. Instead of fixed monthly payments, firms repay investors a percentage of monthly revenue until a predetermined multiple is reached.

Online lenders have streamlined the application process, often providing decisions within days rather than weeks. While interest rates higher than traditional banks, the speed and accessibility make digital lending attractive for many small organizations.

These platforms typically use alternative data sources for credit decisions, including bank account transaction history, social media presence, online reviews and ratings, and industry benchmarks.

Assessing Your Financing Needs and Options

Determining Capital Requirements

Before approaching lenders or investors, conduct a thorough analysis of your financing needs. Consider both immediate requirements and future cash flow projections.

Key factors to evaluate include working capital needs for daily operations, capital expenditures for equipment, technology, or facilities, market expansion costs including marketing and staffing, inventory investments for scaling opportunities, and contingency reserves for unexpected challenges.

Important:

Underestimating funding needs is a common mistake. Build in a 20-30% buffer for unexpected costs or delays in achieving projected revenues.

Matching Financing to Business Stage

Different financing options work better at various business stages:

- Startup Stage: Angel investors, crowdfunding, personal savings, friends and family funding

- Early Growth: Government-backed loans, revenue-based financing, angel investors, small business credit options

- Established Growth: Traditional bank loans, venture capital, asset-based lending, equipment financing

- Mature Expansion: Commercial bank loans, private equity, debt refinancing, retained earnings

Improve Cash Flow Management During Scaling

Effective cash flow management is crucial during development phases when expenses often increase before revenues catch up. Implement these strategies to maintain healthy cash flow:

- Accelerate Receivables: Offer early payment discounts, implement electronic invoicing and follow-up systems, consider invoice factoring for immediate cash, and negotiate shorter payment conditions with new customers.

- Optimize Payables: Negotiate extended payment terms with suppliers, take advantage of early payment discounts when cash flow allows, stagger large expenditures when possible, and consider supplier financing programs.

NB:

Electronic signatures can significantly speed up contract execution and invoice approval processes, directly improving cash flow timing. Yousign's platform reduces document processing time, helping businesses maintain better cash flow control.

Qualifying for Business Financing

Building Strong Financial Foundations

Small organizations qualify for better financing terms when they demonstrate financial stability and development potential. Lenders and investors evaluate several key metrics:

Financial health indicators include debt-to-equity ratio below 40%, current ratio above 1.25, consistent revenue growth, positive cash flow for at least 12 months, and strong gross and net profit margins.

Documentation requirements typically include financial statements (profit & loss, balance sheet, cash flow), tax returns and Company House filings for 2-3 years, business plan with growth projections, personal financial statements for guarantors, and legal documents such as contracts, leases, and licences.

Preparing for the Application Process

Successful financing applications require thorough preparation and professional presentation. Create a comprehensive financing package that tells your business story clearly and compellingly.

Essential components include an executive summary highlighting key points, detailed business plan with market analysis, financial projections with assumptions, management team backgrounds and experience, use of funds statement with specific allocations, and exit strategy or repayment plan.

Good to know:

Professional presentation matters. Ensure all documents are well-organized, error-free, and professionally formatted. Consider working with accountants or business advisors for complex applications.

For organizations seeking guidance on professional documentation and contracts, our secure electronic signatures ensure all financing agreements meet legal standards while accelerating the approval process.

Managing Risks and Building Relationships

Common Financing Pitfalls

Many organizations encounter predictable challenges when seeking growth financing. Over-leveraging by taking on too much debt relative to your ability to service it can lead to cash flow problems. Equity dilution from giving up too much ownership too early can limit future funding options. Mismatched financing using short-term financing for long-term needs creates unnecessary financial stress.

Building Long-Term Success

Implement risk mitigation strategies including diversifying funding sources, maintaining 3-6 months of operating expenses in reserve, monitoring key metrics closely, and planning for multiple scenarios.

Strong lender relationships provide access to better terms, quicker approvals, and increased credit limits over time. Maintain these relationships by providing regular financial updates, communicating proactively about challenges, meeting all obligations promptly, and expanding relationships as your firm grows.

Consider how business loan options in the UK provide comprehensive guidance on securing funding for UK organizations, including government-backed schemes and alternative lending options.

Frequently Asked Questions - Best Practices for Financing Business Growth

What's the minimum credit score needed for business financing?

Most traditional lenders require personal credit scores of 680+, while alternative lenders may accept scores as low as 550, though with higher interest rates.

How long does the typical financing application process take?

Traditional bank loans take 2-6 weeks, government-backed loans 4-8 weeks, and online lenders 24-72 hours. Complex deals can take 3-6 months.

Should I give up equity or take on debt for growth financing?

This depends on your business model, growth projections, and personal preferences. Debt preserves ownership but requires regular payments, while equity provides flexibility but dilutes control.

Accelerating Growth Through Smart Financing

Finance business growth successfully requires understanding your options, preparing thoroughly, and choosing the right funding mix for your specific situation. Whether you pursue traditional bank credits, explore venture capital funding, or consider alternative solutions like asset based lending, the key is matching funding to your business needs and development objectives.

Success business expansion depends on developing strong relationships with financial partners who understand your business and support your expansion vision. These relationships provide access to resources when opportunities arise and guidance during challenging periods.

Electronic signatures play a crucial role in modern funding, enabling faster contract execution, reduced processing time, and improved cash flow management. By implementing digital solutions like Yousign, businesses can demonstrate operational sophistication while accelerating their funding processes.

Ready to Streamline Your Business Growth Financing?

Transform your document workflows and accelerate funding deals with secure electronic signatures.